From Free Trial to payouts in six months

Not sure if you have what it takes to complete one of our challenges? Our Free Trial programs have the answer. Try one and you might just discover a real talent for trading, like Adam, the trader in this story.

Indecision is the enemy of success. A single “what if…” can stand between you and big payouts. If you are not sure which Fintokei challenge should you choose, you can always go for a Free Trial version. It’s your chance to test your skills, no strings attached.

Adam, a trader from the Czech Republic, gave it a shot in late October 2023. He was interested in our ProTrader 10M program. In minutes, he opened an account, installed the platform, and started trading. Within three weeks, he hit the 8% profit target needed to advance to the next evaluation round. That’s where the Free Trial ends. But Adam knew he had what it took.

ProTrader requires two evaluation rounds, with a lower 5% profit target in the second. If Adam could reach 8%, he was ready for the next step. Yet, even then, he hesitated. Four months later, in February, he returned and entered ProTrader for real.

Each evaluation phase took him about 20 days. By early March his evaluation was completed., Adam completed both rounds and secured a ProTrader account with 10 million crowns ($400k). From there, he could start thinking about payouts. And soon, they started rolling in.

If You Can Find Logic in the Markets’ Illogical Moves

Instrument Traded: NASDAQ

Trading Style: Swing

Profit: 180,000 CZK (approx. $7,770)

Adam has been trading with us for seven months. In that time, he’s already earned several payouts. Our analysis has plenty of his trades to choose from, but his standout masterpiece came in early April. In a single trade, Adam earned over $7,770.

Adam’s favorite trading ground is the Nasdaq stock index, where price movements offer a range of opportunities daily. The challenge lies in timing market entry and exit without getting caught by sharp swings. His secret? Follow the fundamentals. In early April, Adam kept an eye on a crucial event: a speech from Jerome Powell, head of the US Federal Reserve. The topic of discussion? Interest rates on the US dollar. Boring for most. Beyond thrilling for traders. That’s because this information can be a potential goldmine.

Here’s the deeper analysis. During his speech, Powell mentioned that future rate cuts would be more data-driven, influenced by inflation reports, labor market data, and the Purchasing Managers’ Index (PMI). The PMI, a key indicator for the service sector’s health, had just been released hours before Powell spoke. The result? Weak PMI data. In most cases, this would be bad news, signaling a struggling economy.

But markets can be unpredictable. Weak PMI suggested the economy needed a boost, aligning with Powell’s hint at rate cuts – a prospect that excited investors. Stocks began to climb, reflecting the market’s response to Powell’s comments. And Adam, following the fundamentals closely, turned this insight into a successful trade.

Adam navigated this setup brilliantly. Just after 5 p.m., as Powell was still speaking, he started speculating on an upward move. But how to confirm it would last? That’s where technical analysis came into play.

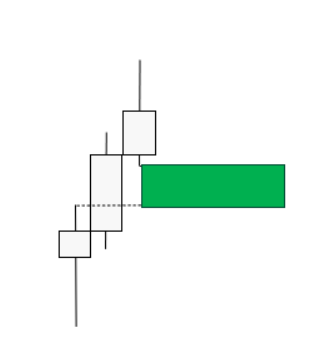

First, Adam looked for a candle formation as a signal. Right before Powell’s main remarks, he saw his first confirmation: the previous low held steady, and a new local high was broken. This signaled a reversal just as Powell’s words were entering the market.

Then, during Adam’s entry, a large green candle formed, creating a Fair Value Gap (FVG). To him, this suggested room for further growth. FVGs are highly valued among traders, as they often indicate an imbalance in the market – a clear deviation from fair value. And for Adam, it was the signal he needed to stay in the trade.

The Bullish Fair Value Gap (FVG) is marked by a gap between the high of the first candle and the low of the third candle.

If you spot an FVG, it’s a good place to wait. Markets tend to return to fill these gaps in subsequent candles, often signaling a potential reversal. But for Adam, that reversal didn’t come. In fact, two more FVGs formed, visible in the chart above as large green candles after minor corrections (we’ve also marked them using black arrows). Adam stayed in his position, confident the FVGs signaled a continued rise.

In the end, Adam held his trade for nearly 24 hours, navigating a volatile market full of price anomalies. His patience paid off, taking him up to a strong resistance level at around 18,350 points.

Adam’s Secret Weapon? The ProTrader $400k Account

Most of Adam’s trades on the Nasdaq happened during big news events – a high-risk strategy under normal circumstances. But with a ProTrader 10M account, Adam took on far less risk. Why? Because even with a conservative risk of 0.1% per trade (while most traders go up to 1%) and a target profit of 0.2%, he can make around $8k with a smaller position size (under 1 lot). Having $400k in your account makes all the difference!