ATRでボラティリティ分析を攻略!損切りや利確も見えてくる

「相場の勢いが強いのか、それとも落ち着いているのか」このような疑問を抱えながら、エントリーや損切りに迷った経験はありませんか?

そんなときに役立つのが、ボラティリティを数値化してくれる指標「ATR(アベレージ・トゥルー・レンジ)」です。

ATRはボラティリティを計算することに特化した数少ないインジケーターです。

この記事では、ATRでボラティリティを計算する仕組みや他のインジケーターとの違い、そして実際にATRを活用したトレード手法などを以下の項目で詳しく解説しています。

- ATRでボラティリティを計算する仕組み

- ATR以外のボラティリティを測定できるインジケーター

- VIXはボラティリティを把握できる指標として有名

- ATRのボラティリティを実際のトレードで活用する

- ATRを使うならFintokei

- まとめ

ATRでボラティリティを計算する仕組み

ATR(アベレージ・トゥルー・レンジ)では、まず高安値やを基にした以下3つの計算式で算出された値の中で、最も大きい値幅がTR(トゥルー・レンジ)となります。

- 当日の高値-当日の安値

- 当日の高値-前日の終値(終値を下回る場合)

- 前日の終値-当日の安値(終値を上回る場合)

そして設定期間内で連続して同じ計算を続け、その平均値を取るとATRの値となります。

例えば「14期間」のATRを求める場合、直近14本のTRの平均値を以下のように計算します。

ATRₙ =(TR₁ + TR₂ + … + TR₁₄) ÷ 14

ATRで実際にボラティリティを計算してみる

実際にある通貨ペアの1週間(5営業日)の価格データを使って、ATRを計算してみましょう。

| 日付 | 高値 | 安値 | 終値 | 前日終値 | TR |

| 月 | 110.0 | 109.0 | 109.5 | – | 1.0 |

| 火 | 110.2 | 109.3 | 110.0 | 109.5 | max(0.9, 0.7, 0.5) → 0.9 |

| 水 | 110.5 | 109.8 | 110.2 | 110.0 | max(0.7, 0.5, 0.2) → 0.7 |

| 木 | 111.0 | 110.0 | 110.8 | 110.2 | max(1.0, 0.8, 0.2) → 1.0 |

| 金 | 111.5 | 110.7 | 111.3 | 110.8 | max(0.8, 0.7, 0.5) → 0.8 |

この5日分のTRを以下のように平均すると、ATRは0.88になります。

ATR₅ = (1.0 + 0.9 + 0.7 + 1.0 + 0.8) ÷ 5 = 4.4 ÷ 5 = 0.88

ATR以外のボラティリティを測定できるインジケーター

ATR以外にも、以下のようなインジケーターを使うことでも相場のボラティリティを把握することができます。

| インジケーター | 計算の仕組み | 長所 | 短所 |

| ATR | TR(高値・安値・前日終値から最大値幅)を一定期間で平均 | ギャップも含めてボラティリティを正確に反映 | トレンド方向は判断しづらい |

| Standard Deviation | 標準偏差 | 仕組みや見方が分かりやすい | ギャップは考慮しづらい |

| ボリンジャーバンド | 移動平均 ± 標準偏差×係数 | トレンドとボラティリティの両方が視覚的にわかる | トレンド転換時にダマシが出やすい |

| ケルトナーチャネル | 移動平均 ± ATR | トレンド方向とボラティリティを同時に捉えられる | レンジでは機能しづらい |

| 移動平均乖離率 | 現在の価格と移動平均線との差 | 相場の過熱感を確認しやすい | ボラティリティそのものは見えづらい |

上記5つの大きな差はボラティリティが、標準偏差をもとに計測されているか、または終値などの相場価格そのものをもとに計測されているかです。

Standard Deviation

Standard Deviation(標準偏差)は、その名の通り価格のばらつきを統計的に測定する「標準偏差」をもとにボラティリティを測定するインジケーターです。

ボラティリティを把握できるインジケーターとしては、かなり王道だといえます。

見た目はATRと非常に似ており、かつStandard Deviationが上昇するとボラティリティの高まり、下落するとボラティリティの減少を表す点も同じです。

ただし終値の価格分布のみをもとに計算されているので、前日の終値や高安値にも注目しているATRと比べてギャップ(窓開け)は考慮されづらい点がデメリットです。

ボリンジャーバンド

ボリンジャーバンドは、移動平均線を中心に価格のばらつきを表す「標準偏差」を加減して上下にバンドを表示します。

統計的な数値である標準偏差に基づいているので、その点が純粋な値動きの大きさだけを計測するATRとは異なります。

価格変動が大きくなるとバンドも広がるので、ボラティリティを視覚的に把握しやすく、かつ中心にある移動平均線でトレンドも把握できることが活用するメリットです。

一方で視覚的に分かりやすいがゆえに、シグナルを信じすぎるとだましに遭いがちである点には注意が必要です。

ボリンジャーバンドのおすすめ設定については、以下の記事で詳しく解説しているのでぜひ参考にしてください。

≫ボリンジャーバンドの期間設定は「20」がおすすめ?期間設定時のポイントを解説

ケルトナーチャネル

ケルトナーチャネルは、移動平均線にATRの値を加減したインジケーターです。

見た目はボリンジャーバンドと似ていますが、ボリンジャーバンドは標準偏差を、ケルトナーチャネルはATRを基準にバンドを表示している点が違います。

ギャップ(窓開け)を考慮できるというATRのメリットを受けられるとともに、ボリンジャーバンドのようにトレンドも把握できます。

一方で、レンジ相場ではだましが増えやすいので注意しましょう。

移動平均乖離率

現在の価格が移動平均線の水準からどれだけ離れているかを示すインジケーターで、相場の過熱感や反転の目安として広く使われています。

乖離率が高まるとそれだけボラティリティが高まっていると判断することができます。

ただしこのインジケーターは価格が平均からどれだけ離れているかという「水準」に注目しており、価格の変動幅や勢いといった「ボラティリティ」を測定する目的には不十分です。

ボラティリティはATRなどほかのインジケーターで確認し、その結果として相場が行き過ぎていないかの確認に移動平均乖離率を使うといった組み合わせがおすすめです。

VIXはボラティリティを把握できる指標として有名

VIX(Volatility Index)は、米国S&P500指数のオプション価格から算出される「今後30日間の予想ボラティリティ」を示す指標です。

ボラティリティには大きく分けて、ヒストリカルボラティリティ(HV)とインプライドボラティリティ(IV)の2種類があります。

ヒストリカルボラティリティ(HV)は、過去の価格変動から測定できるもので、ATRやStandard Deviationなどのインジケーターで確認できる数値が該当します。

一方、VIXで確認できるインプライドボラティリティ(IV)は、オプション市場における需給から導かれる「将来の予想ボラティリティ」である点が特徴です。

市場でこれからボラティリティが高まりそうかを測定したい場合は、ATRだけでなくVIXも確認しておくことがおすすめです。

VIX指数の見方については、以下の記事で詳しく解説しているのでぜひ参考にしてください。

≫VIX指数でMACDのゴールデンクロスを確認する意味とは?トレードでの使い方も解説!

ATRのボラティリティを実際のトレードで活用する

ATRで確認できるボラティリティを実際のトレードで活用する方法について、以下の3つを紹介します。

- ボラティリティブレイクアウトを銘柄選定の基準にする

- ボラティリティの高まりを順張りのきっかけにする

- 損切りと利益確定幅を決める

ボラティリティブレイクアウトを銘柄選定の基準にする

ボラティリティブレイクアウトとは、ATRの水準が過去と比べて大きく上昇する動きを指し、強いトレンドの始まりを示唆する重要なシグナルです。

したがって、ボラティリティブレイクアウトを基準にトレンドが発生しそうな銘柄を選定します。

一般的には、当日の値幅がATRの1.5倍以上になったかどうかでブレイクアウトを判断します。

他にも以下のようなブレイクアウトもあるので、注目して銘柄を選定していきましょう。

- レンジからの急上昇:材料待ちだった銘柄

- レンジからの急下落:高値圏での売り圧力が強まりやすい銘柄

- 上昇トレンド中の急落:過熱気味の銘柄

- 下降トレンド中の急騰:材料反転やショートカバーが起きやすい銘柄

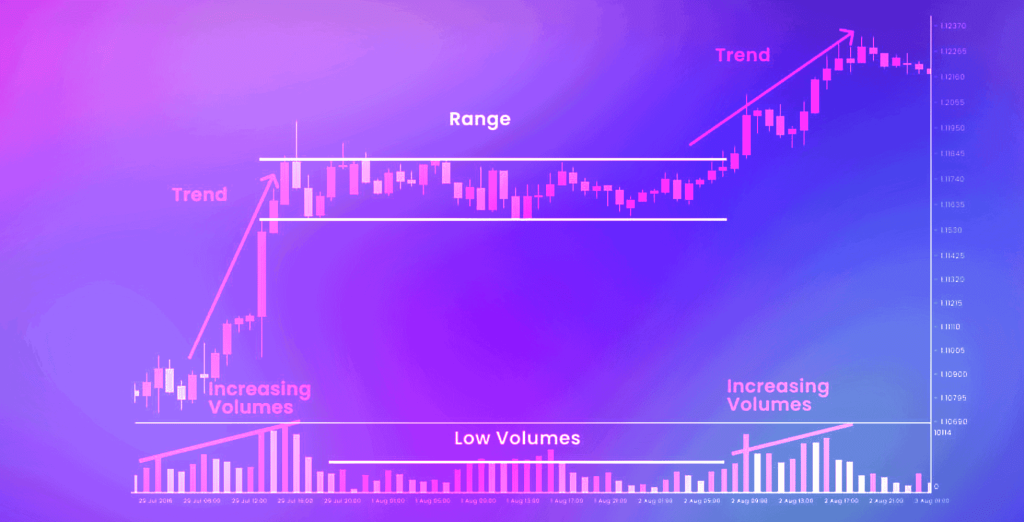

ボラティリティの高まりを順張りのきっかけにする

トレンドフォロー(順張り)において、ATRを使ってボラティリティの上昇を確認することは、エントリーの強力な根拠になります。

特に移動平均線と組み合わせることで、価格の方向性と勢いの両方を判断することが可能です。

たとえば、移動平均線が右肩上がりのときにATRの値が急上昇していれば、上昇トレンドが強く動き出したサインと捉えられるので、押し目買いのチャンスを狙います。

一方でATRが徐々に低下しているのであれば相場のエネルギーが失われてきている証拠なので、利益確定のサインとなります。

損切りと利益確定幅を決める

ATRは、相場のボラティリティに応じて現実的な損切りと利確幅を決めるためにも役立ちます。

例えばATRが1.4(=140pips)付近で推移しているケースが多い場合、1日の平均的な変動幅は約1,400pipsと判断できます。

したがって、リスクリワード「2」を狙うのであれば損切り幅を140pips、利益確定幅を280pipsにするとバランスの取れた戦略が立てられます。

このように一定のpips数を固定で設定するよりも、ATRを活用することで現在の相場環境に合わせたリスク管理が可能になります。

リスクリワードの決め方については、以下の記事で詳しく解説しているのでぜひ参考にしてください。

≫トレードにおけるリスクリワードの重要性|計算方法や理想の値

ATRを使うならFintokei

Fintokeiとは、個人トレーダーがプロトレーダーに挑戦する場を提供しているプロップファームです。

Fintokeiでは、デモ環境を使って仮想資金を運用していき、損失率を抑えつつ一定以上の利益率を達成することで公認のプロトレーダーになることができます。

Fintokei公認のプロトレーダーになると、データ提供料としてデモ口座における取引利益額をもとに報酬がトレーダーへ支払われます。

Fintokeiでは紹介したATRを活用できることはもちろん、他のトレードスキルについてより深く学べる動画やブログの学習コンテンツが豊富に用意されています。

Fintokeiのサービスを体験できる無料トライアルも実施していますので、ATRを使ってプロトレーダーを目指したい方はぜひ挑戦してみましょう。

Fintokeiについては、以下の記事で詳しく解説しているのでぜひ参考にしてください。

≫プロップファームFintokeiとは?おすすめする理由や始め方を紹介!

まとめ

この記事では、ATRの計算方法から他のボラティリティ指標との違い、そして実際のトレードへの活用方法までを詳しく解説しました。

ATRは、過去の価格変動をもとにボラティリティを数値化できる便利なツールです。

特に損切りや利確ラインの設定、トレンドの判断、銘柄選定の精度を高めるうえで、ATRは非常に強力な味方になります。

今回紹介した活用法をもとに、まずは自分の取引スタイルに合わせてATRの使い方を試してみましょう。

もしボラティリティ分析を武器にして本格的にトレードスキルを磨きたいなら、Fintokeiの無料トライアルを活用して、ATRを使ったプロトレーダーへの第一歩を踏み出してみてください。