How to trade candlestick charts: A beginner’s guide to candle patterns

At first glance, they look like simple rectangles with sticks. But once you know what to look for, candlestick charts reveal who’s in control, when trends shift, and when it might be the right time to trade. In this guide, you’ll learn how to read candlesticks, spot the best patterns, and trade them like a pro.

Why you should care about candlestick charts

Imagine being able to “read” what the market is thinking right now – and not just that, but also what might happen next. No magic. Just candlestick patterns.

Those red and green “blocks” may look confusing at first, but they’re the language of the market. And with the right knowledge, you can learn to speak that language too.

Why candlestick charts matter

Candlestick charts are the foundation of technical analysis. Whether you’re trading forex, crypto, or stocks – you’ll always find traders who rely on candlestick chart analysis to decide when to buy and when to step back.

Compared to basic line charts, candle charts offer a much deeper view into price action. They reveal the emotions behind every move – fear, greed, hesitation, or confidence. And reading those emotions gives you an edge when making trading decisions.

💡 Fintokei tip

Candlestick patterns aren’t magic signals. But they’re real clues that can help you stay in tune with the market. Once you understand what a forex candle means, your decisions get quicker and smarter.

What is a candlestick and why it matters

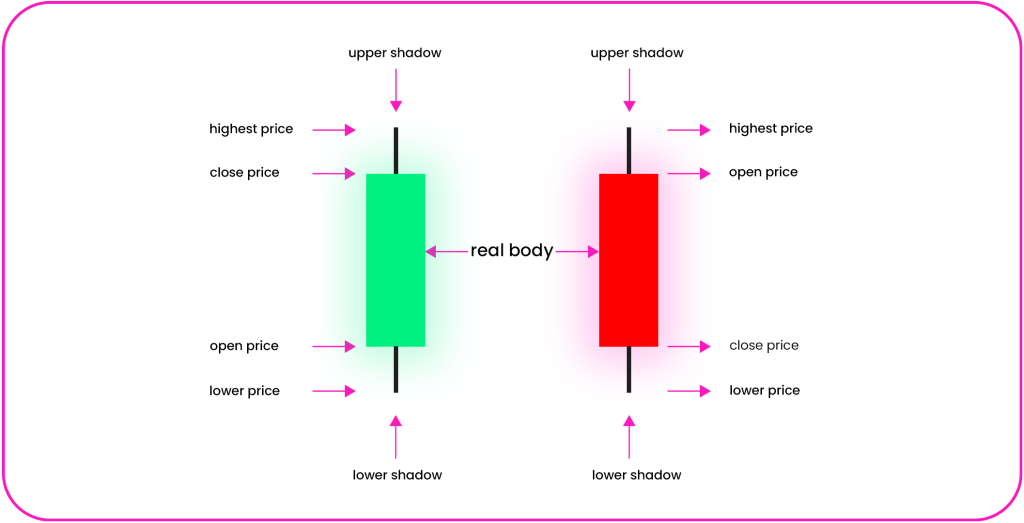

A candlestick isn’t just a random chart pattern – it’s a mini story about what happened in the market during a specific time period. Every forex candle contains four key price points:

- Open – where the price started,

- Close – where the price ended,

- High – the highest point the price reached,

- Low – the lowest point during that time frame.

These four values create the shape of the candlestick. And that shape is crucial for any trader.

- The body (the main block) shows the distance between the opening and closing prices. If the price went up, the body is usually green or white. If it went down, it’s red or black.

- The wicks (also called shadows) show how far the price moved above or below the body – giving you a full view of market activity.

That’s one single candle. Now imagine lining up hundreds of them – suddenly, you’ve got a full picture of price movement. That’s what candlestick chart analysis is all about – reading the market like a book.

Every candlestick has meaning

The shape, size, and color of each candle tell you way more than a long-winded analyst note. You can learn what’s happening right now – and what might happen next.

- A long body = strong momentum, bullish or bearish.

- Long wicks = market indecision.

- A small body = hesitation, low conviction.

This is what traders call price action – reading the raw price without relying on heavy indicators. And candlestick trading is the foundation of that mindset.

How to read candlestick patterns? Download our e-book!

How to read a candlestick chart: First step to market analysis

Now that you know what a candlestick is and how it works, it’s time to level up – by learning how to read candlestick charts as a whole.

Because a single forex candle is just a snapshot. But when you start spotting trading candlestick patterns, that’s where the real power begins.

Each candlestick has meaning. But once you start connecting them and seeing the bigger picture, you’ll uncover something called candlestick patterns – repeating combinations that show up in specific market situations.

Here are some quick examples:

- Several green candles in a row with large bodies? That usually signals strong bullish momentum.

- A small candle with a long upper wick at the top of a market trend? Could mean buyers are losing steam.

- A tiny body with long wicks on both sides? The market is confused and directionless.

Timeframes: Which one should you watch?

Each candlestick represents price movement within a specific time period – that’s your timeframe. If your chart is set to 5 minutes, each candle shows what happened in that 5-minute window. If it’s a daily chart, one candle = one full trading day.

💡 Fintokei tip

Candlestick patterns aren’t magic signals. But they’re real clues that can help you stay in tune with the market. Once you understand what a forex candle means, your decisions get quicker and smarter.

Don’t expect perfection

Real charts don’t look like textbook examples. Markets are messy and emotional. The best candlestick trading patterns often appear a bit “off” or slightly different from how you saw them in tutorials. That’s fine.

The point is to understand the idea behind the pattern – who’s in control? Buyers or sellers?

The most popular candlestick patterns and how to trade them

There’s one unspoken rule in trading – if a pattern shows up often enough, the market “remembers” it. And that’s exactly what candlestick patterns are all about. There are tons of them, but let’s start with the most common ones – the ones you’ll actually see in real charts and can trade even as a beginner.

Bullish patterns – signals to buy

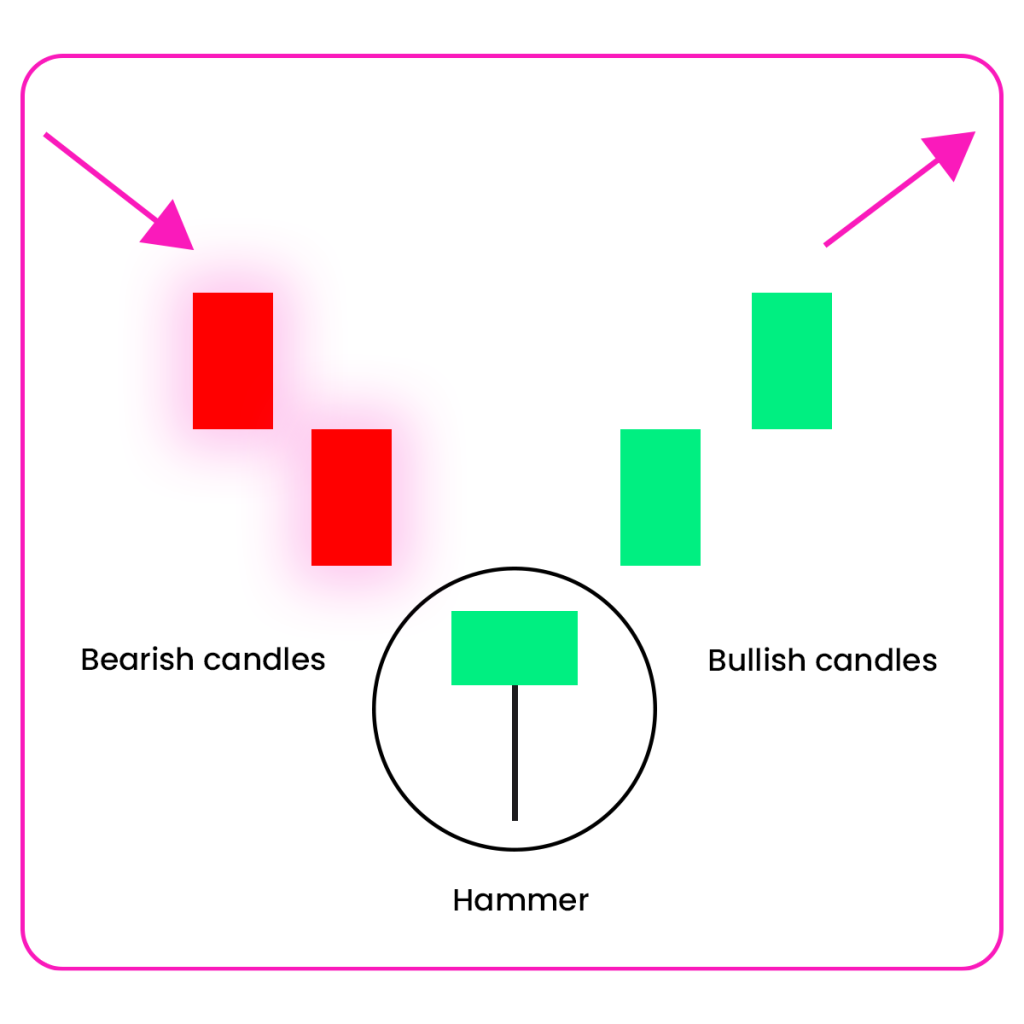

Hammer

Looks like a small rectangle with a long lower wick. It appears at the bottom of a downtrend and signals that sellers tried to push the price lower – but buyers stepped in and pulled it back up.

How to trade it: Wait for the next candlestick. If it moves up, you can enter a buy trade. Set a clear exit level in case the market turns against you – for example, just below the hammer’s low.

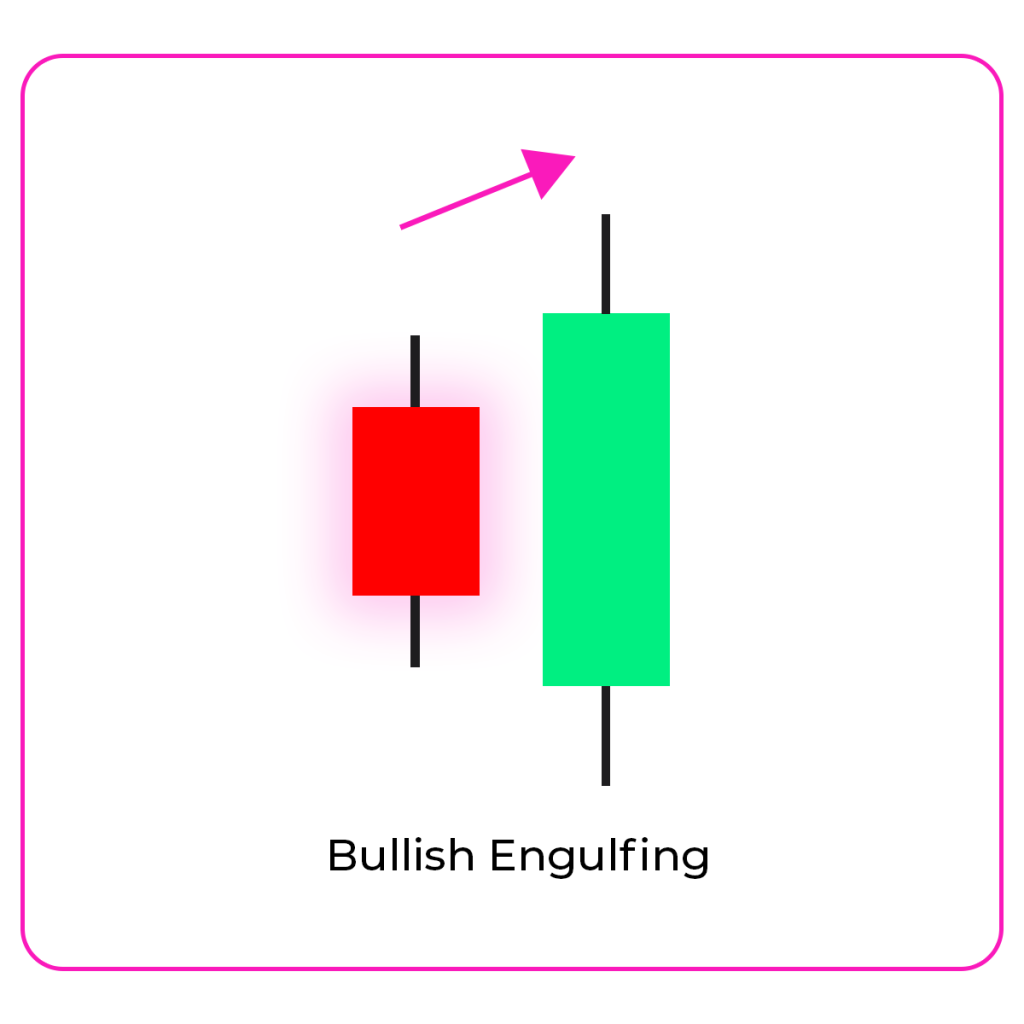

Bullish engulfing

A classic forex candlestick pattern made up of two candles. First one is red (price dropped), second one is green (price climbed) – and it completely covers the first. That means buyers are gaining control.

How to trade it: If another green candle follows, consider buying. Look for confirmation – like rising volume or support from another candle pattern.

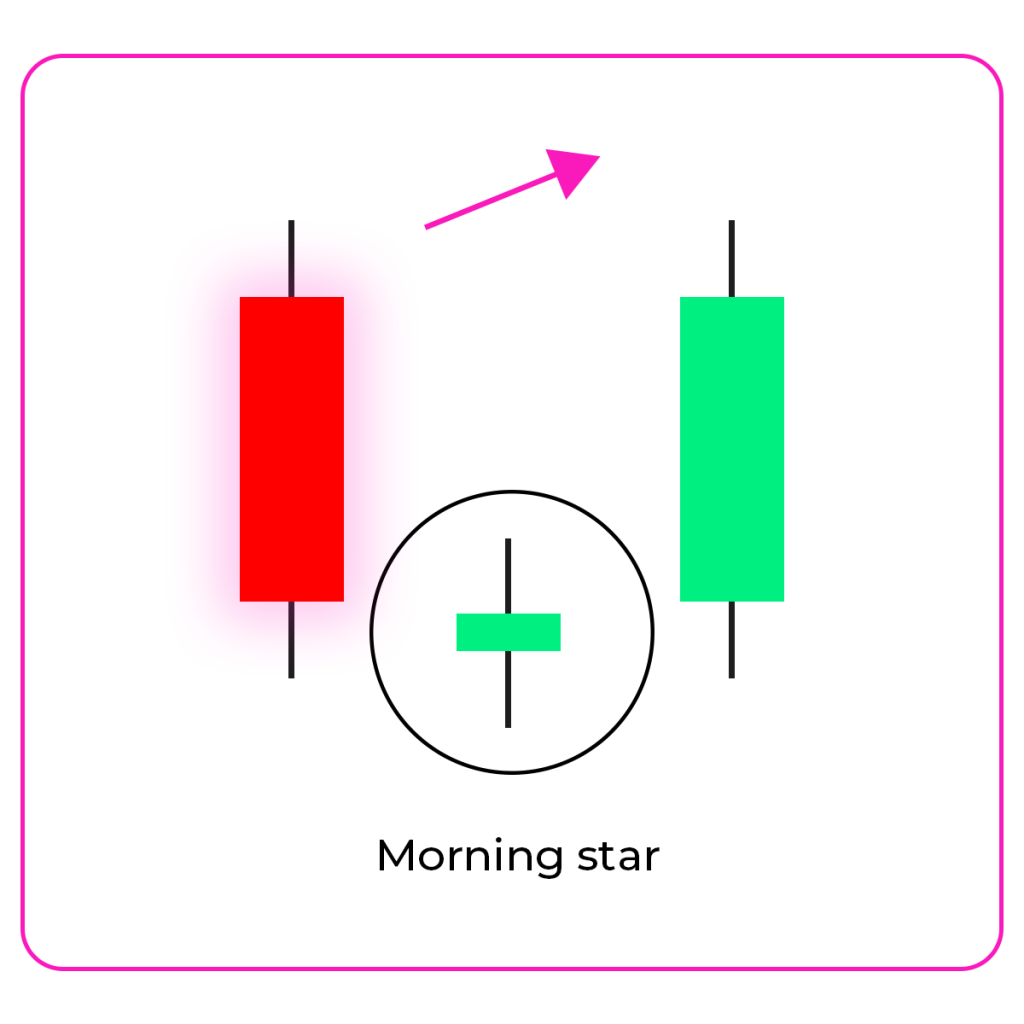

Morning star

This trading candlestick pattern has three candles: a strong bearish candle, a small indecision candle (often a doji), and a strong bullish candle. It signals a possible reversal to the upside.

How to trade it: If the price starts to rise after the third candle, you can enter a buy trade. Define your exit in case things reverse.

Bearish patterns – signals to sell

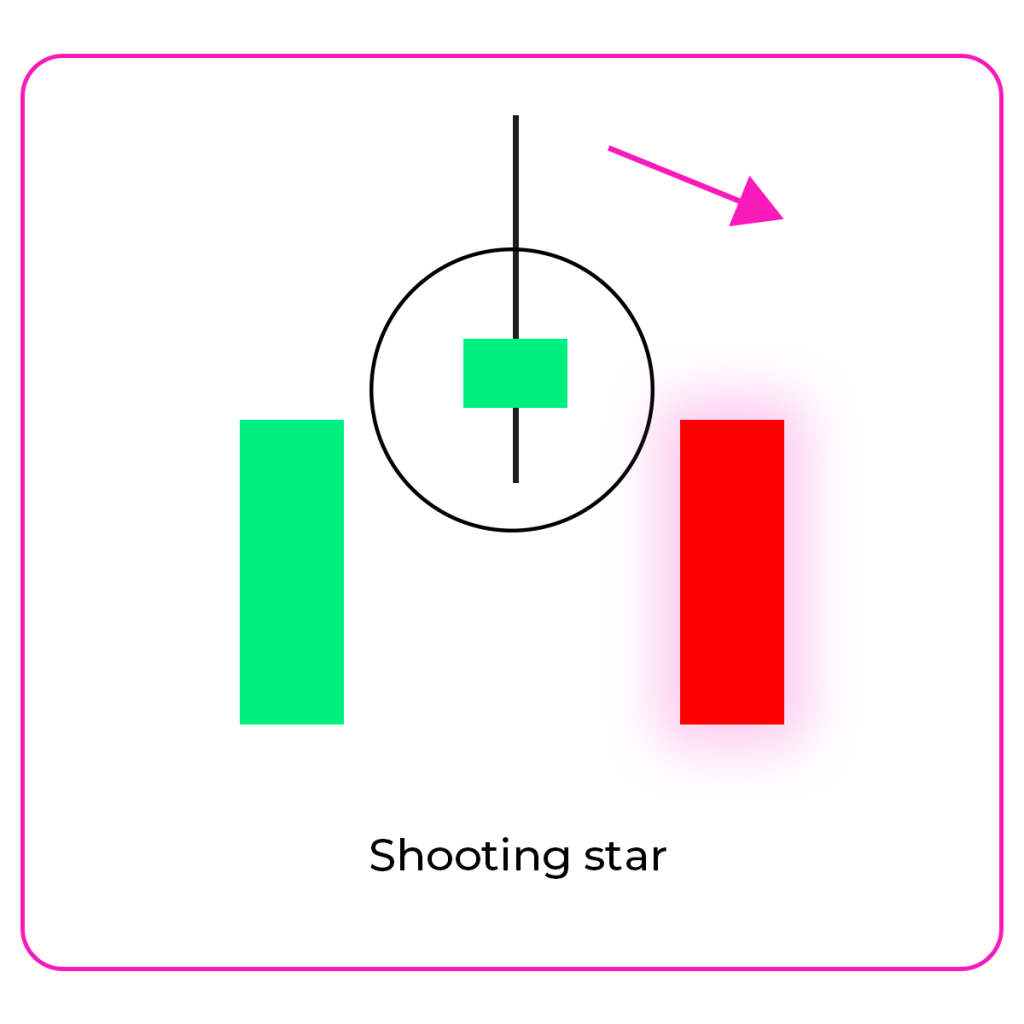

Shooting star

A small-bodied candle with a long upper wick. Appears after an uptrend and tells you the market tried to break higher but failed. Sellers took over.

How to trade it: If the next candlestick is bearish, you can either sell or close any open buy positions. Always have a risk plan in place.

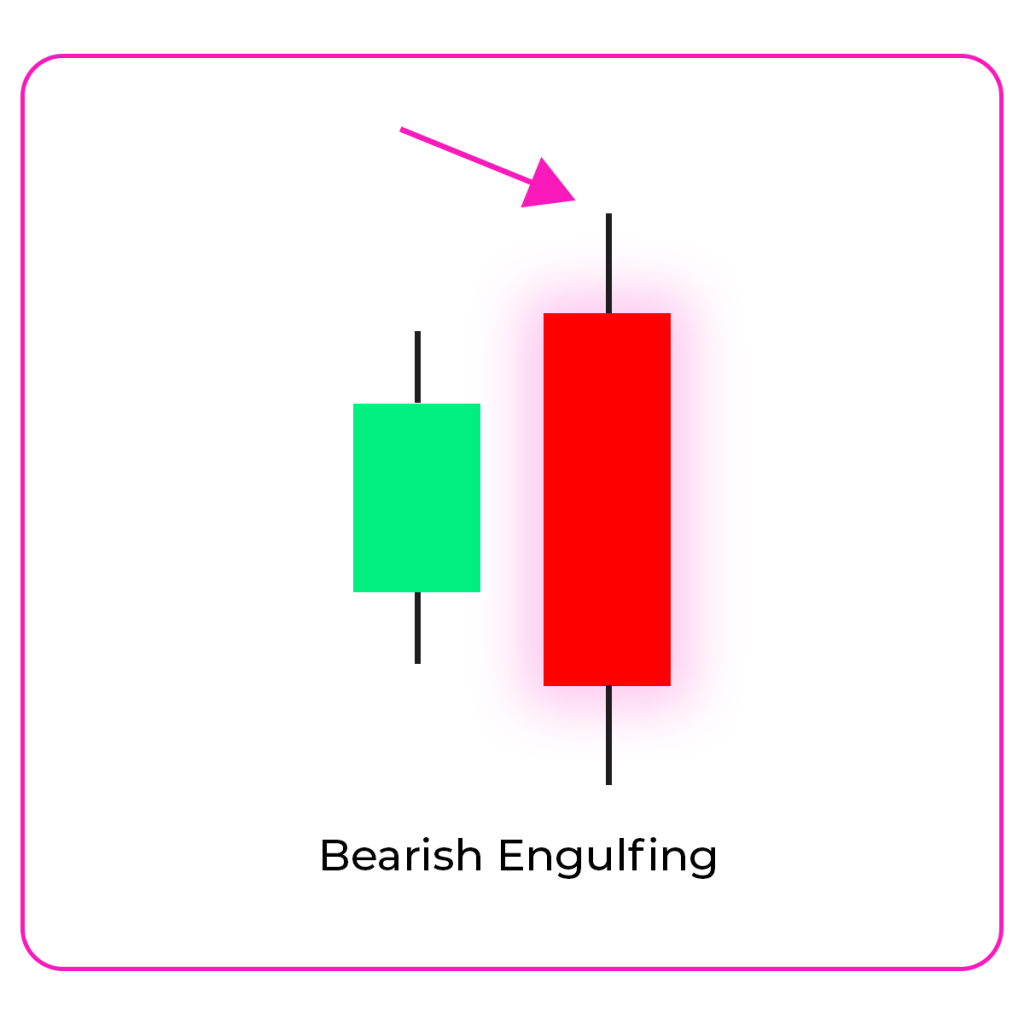

Bearish engulfing

The opposite of the bullish version. The first candle is green, second is red – and the red one engulfs the green one. Time to get cautious.

How to trade it: If followed by more selling pressure, this candlestick pattern can be a good reason to short. Look for volume or structure confirmation.

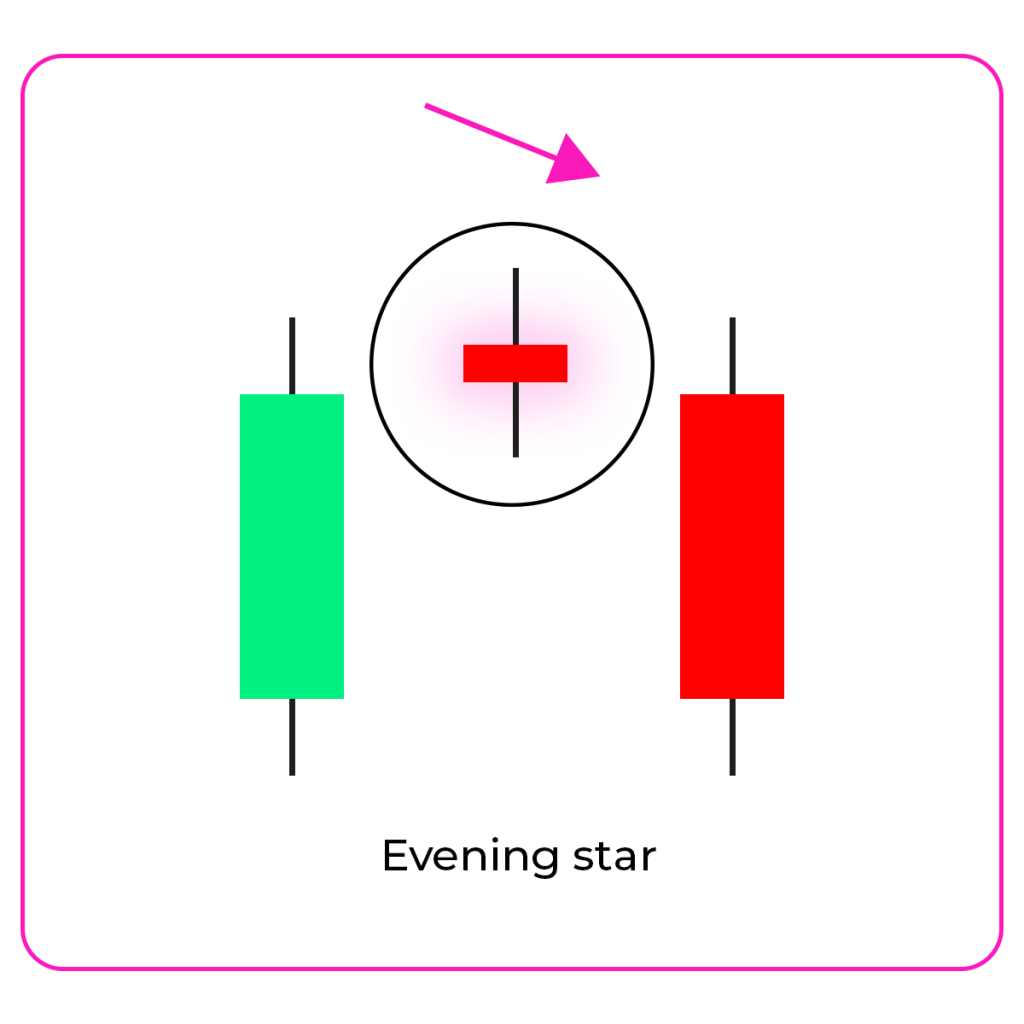

Evening star

Three candles: a bullish candle, a small indecisive one, and then a strong bearish candle. A clear warning that the uptrend may be ending.

How to trade it: If the market starts dropping after the third candle, you may want to sell or exit your longs.

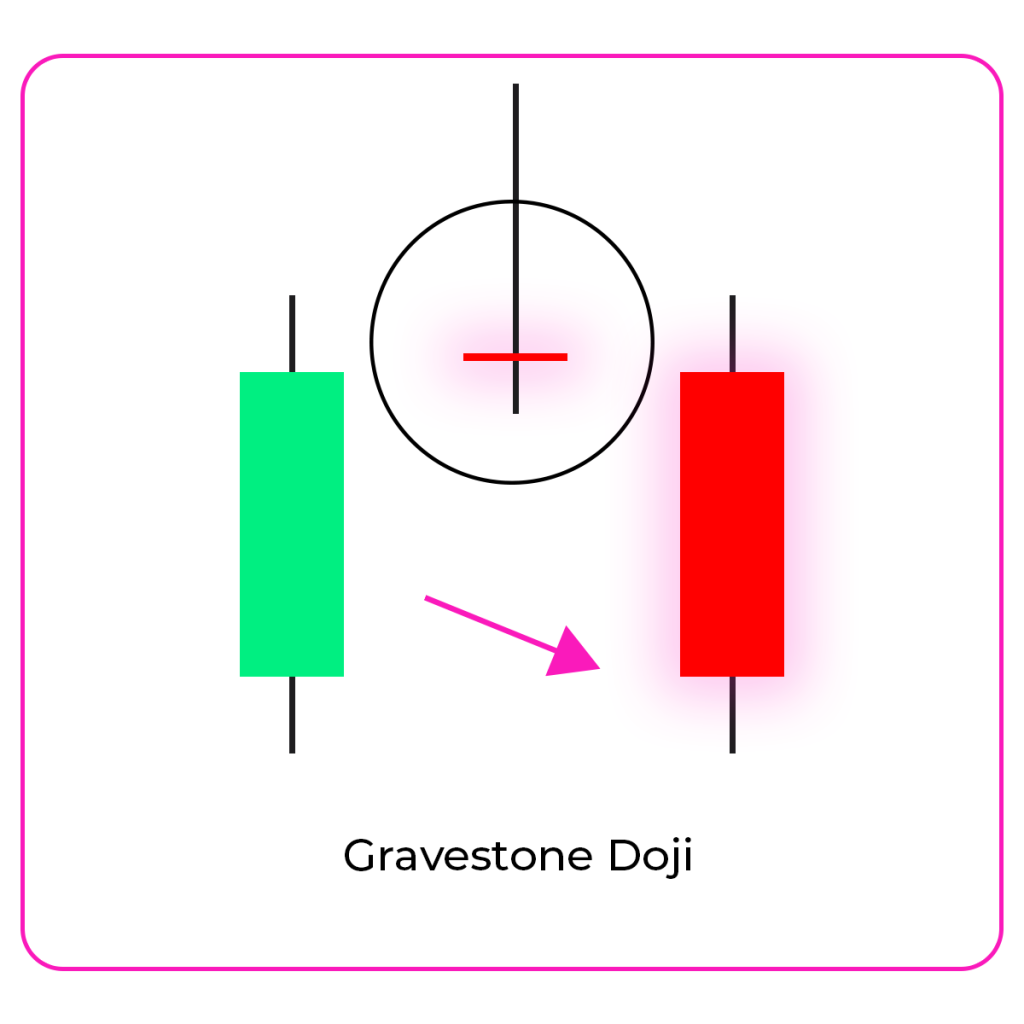

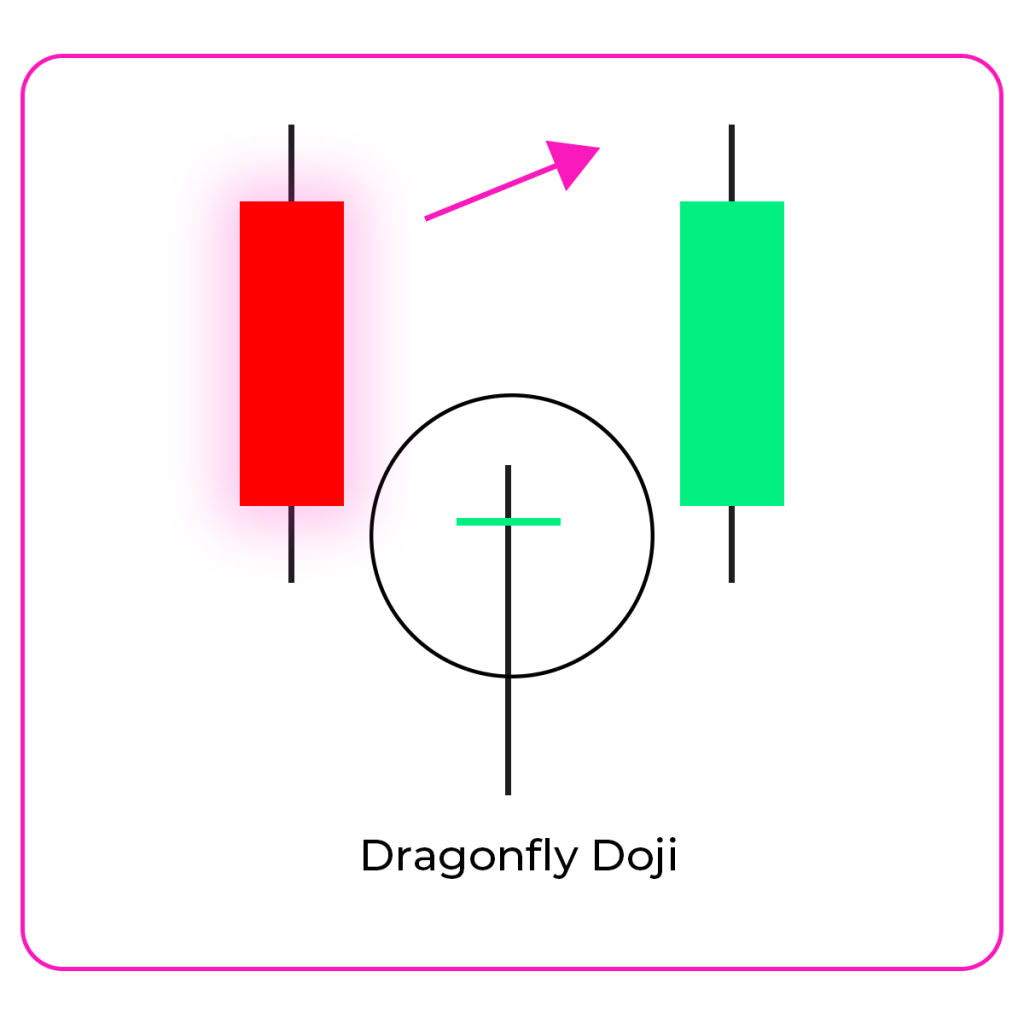

Neutral patterns – market indecision

Doji

A candle with almost no body – open and close prices are nearly the same. It means the market has no clear direction.

How to trade it: A doji alone isn’t enough. Wait to see what happens next. If a strong move follows, that’s your potential signal.

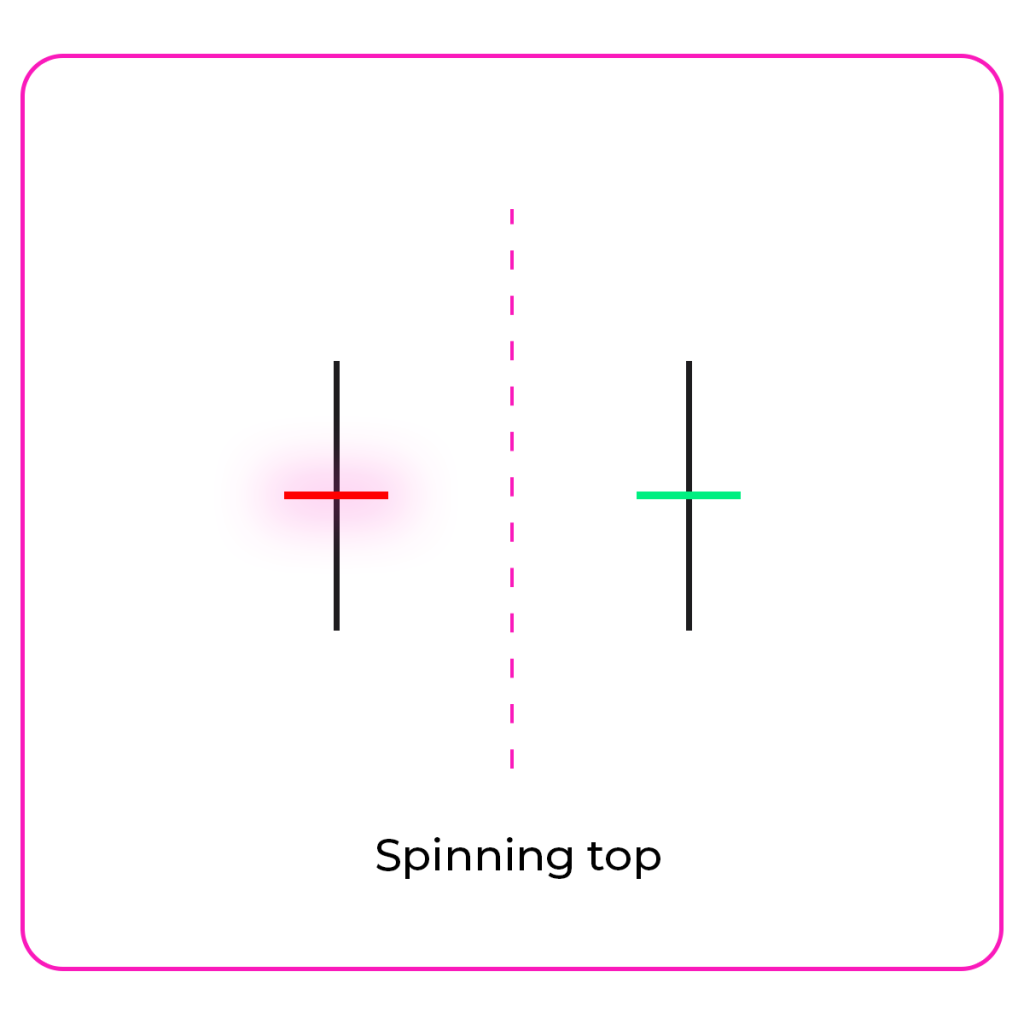

Spinning top

A candle with a small body and long wicks on both sides. Traders are hesitating. Often appears before a change in volatility.

How to trade it: Not a strong signal on its own. Watch the next few candlesticks to see if a clear trend emerges.

How to trade candlestick patterns: Strategy for beginners

Knowing the patterns is great – but it’s not enough. To really use candlestick trading in the real world, you need a trading plan. A proper strategy based on candlestick chart analysis helps you make decisions with logic, not emotions. And that’s rule #1 in trading.

- Pick the right market and timeframe

As a beginner, stick with forex pairs that are highly liquid – like EUR/USD, GBP/USD, or USD/JPY. These tend to respect candlestick patterns more consistently.

And when it comes to timeframes, go with the daily (D1) or 4-hour (H4) charts. The signals are clearer, and you won’t feel rushed into a decision.

- Focus on specific candlestick patterns

Don’t try to memorize every forex candle pattern out there. Stick to the essentials:

- For buys: hammer, bullish engulfing, morning star

- For sells: shooting star, bearish engulfing, evening star

💡 Fintokei tip

It’s not about how many trades you make. It’s about how solid your setup is. Fewer trades, smarter choices.

- Always wait for confirmation

One candle doesn’t guarantee anything. You need confirmation – an extra sign that your idea makes sense. That could be:

- the next candlestick moving in the same direction,

- a spike in volume (if your platform shows it),

- a breakout from support/resistance,

- combination with another pattern (like a double top or bottom),

- or crossing of moving averages with the MACD indicator.

- Define your entry, stop-loss, and take-profit

Every trade should have:

- Entry point – usually after the confirmation candle closes.

- Stop-loss – for example, just below the hammer’s wick or above a shooting star.

- Take-profit – either near the next resistance level or based on a 1:2 risk/reward ratio.

This keeps you in control – and control is what successful trading candlestick patterns is all about.

- Backtest and practice on a demo account

Before risking, test your strategy on past charts. Find places where patterns appeared. See what the market did next. Use a demo account to practice your entries, exits, and risk control – all without pressure.

Summary

If you made it this far – congrats! You’ve got a solid base to start using candlestick charts in your trading. It’s not magic. It’s all about observation, patience, and following a plan.

✅ Every candlestick tells a story – who was in control, where the market tried to go, and how traders reacted.

✅ Candlestick patterns aren’t rules – they’re signals of probability. They don’t guarantee what will happen. They just hint at what might.

✅ The best candlestick patterns are simple, clear, and make sense in context. A hammer at the end of a downtrend means more than one in the middle of chaos.

✅ A forex candlestick is more than a visual – it’s a window into market sentiment.

✅ Trading candlestick patterns should be part of your strategy. Just seeing them isn’t enough – you need to know how to react.