“The main advantage of the ProTrader challenge is that there’s no need to rush,” says the latest Fintokei Star from Poland

Our newest Fintokei discovery is, once again, from Poland—and once again, his name is Kamil. Unlike the previous Kamil, though, this one trades full-time. But surprisingly, he doesn’t recommend full-time trading to others. Why? You’ll find out in this interview.

Another Kamil, another trader from Poland, another father—but we swear it’s a different person!

With 10 years of trading experience and a unique approach to full-time trading, today’s Kamil has an interesting perspective. He actually doesn’t recommend full-time trading and tells traders who are striving for it one simple thing: “Appreciate the fact that you have a stable income!”

We admit—this is not something you hear often in trading circles. But some of Kamil’s other opinions are just as unconventional. What exactly are they? Read on.

When your very first trade doubles your deposit

Hi Kamil, and thanks for joining us for this interview. I have to say, for our readers, this might feel a bit like déjà vu, because the last Fintokei Stars interview was also with a trader named Kamil from Poland. So, can you tell us something about yourself that would set you apart from the previous Kamil? (laughs)

Hey, thanks for having me. Well, I’m 34 years old, and I’ve been trading since 2011. Over the years, I’ve really thrown myself into it—I’ve even won a few smaller trading competitions. I have a small community of traders around me with whom I share my insights, and I have a trading book in progress. And when I’m not trading, I spend time with my family—I have a 4-year-old son and a 1-year-old daughter.

Nice! So, a father of two—just like the last Kamil. I swear to our readers, this is really just a coincidence! (laughs) But jokes aside—you mentioned leading a small trading community and writing a book. That sounds like you’re almost at a professional level in trading. Is that right?

Yes, that’s true. I trade full-time, but that still means I have more time for my family than if I worked a regular 9-to-5 job. That said, getting to where I am now was anything but easy.

We’ll definitely go over your journey. But let’s start from the beginning. What was the initial spark that made you say, “Yes, I’ll try trading”? Was it dissatisfaction with work, the desire for extra income, or the pursuit of freedom?

I don’t think there was one big moment that set me on the path to trading. It was more like—I stumbled upon an ad from a broker one day that promised the possibility of making $500 in two minutes. I clicked on it purely out of curiosity, but also because, at the time, I needed the money (laughs). And you know how it goes—I opened an account, deposited money, and started trading.

Wow, now that’s a successful ad campaign! How did things go from there? Did you go straight to a live account without trying a demo first?

Yeah. There was zero time between seeing the ad and making my first trade. I just opened a live account, deposited $500, and jumped right in. Maybe it’s because I’ve always been good with computers and programs in general, so it didn’t seem complicated to me. I just took the bait like a fish (laughs).

You must be the dream of every broker’s marketing department (laughs). Do you remember your very first trade?

Of course! I think every trader remembers their first trade, and if they say otherwise, they’re lying. Mine was in crude oil, because that’s what the ad was promoting. And I actually made $500 in just two minutes. I entered the market just before an important fundamental release.

But then came a huge red flag. When I tried to close the position and cash in my profit, it wouldn’t let me. I kept clicking, but my trade only closed when it dropped into a loss. So, I immediately withdrew what was left of my deposit and started taking trading a bit more seriously.

That’s quite an unusual first trade. So, you doubled your account on the first trade—only to lose it all?

Exactly. I could have had $1,000, but because of the broker, I ended up $100 in the red. So I withdrew the remaining $400 and left. That trade was pure luck—nothing planned.

Trading and inspiration

Did anyone help or inspire you when you started?

Yes, there were a few people. One of them I mention often, but we don’t talk much anymore, so I’m not sure where he is now. His name is Dawid, and in Polish trading circles, he’s well known for his blog—spekulant.com.pl.

I also learned from Steve Mauro, who helped me understand concepts that traders today are obsessed with under the name ICT (Inner Circle Trader).

ICT has almost become a cult. Do you see it that way?

Yeah, I agree. The thing is, most of the techniques he teaches aren’t even his—they’re much older. The guy just has massive reach. That said, I’m not criticizing him. I know several traders who have found success with ICT. But in my opinion, their success isn’t so much about the methodology itself but rather about how that methodology shaped their trading mindset.

Why full-time trading isn’t for everyone

Would you say this shift in mindset was the key moment in your trading career? Or was there something else?

There were a few key moments. One was when I managed to grow a small account by 1,200%, which led me to quit my job. But then I faced reality. People think trading gives you freedom, and yes, it can—but only if you have an external income. Once I quit my job, I became a slave to the markets. My entire livelihood depended on what was happening in the markets.

So, I ended up staring at charts for hours and hours every day. This went on for months, and I was just going in circles. That’s why I eventually took another job with decent pay and spent two years building a financial cushion. It wasn’t until 2019 that I returned to full-time trading—but this time, I didn’t have to stress about my results. It’s been six years now that I’ve been trading full-time.

Fintokei, ProTrader, and the challenge advantage

How did you hear about Fintokei, and what made you try the challenge?

Before Fintokei, I tried a futures prop firm that only allowed a 3% max loss limit. When I compared it with Fintokei, it was a no-brainer—Fintokei was much more trader-friendly. Sure, ProTrader has two evaluation phases, but the max loss limit is 10%.

Another major difference? Payouts.

In that futures firm, you could withdraw all your profits—but you’d lose your account. You could withdraw half, but the remaining half stayed for trading. With Fintokei, I split profits with the firm, but after a payout, my account resets to the original balance—with the same 10% max loss limit. That’s a huge advantage.

And how did your payouts go? What was your biggest “win” with Fintokei?

You know what? I’ll answer this in a slightly unconventional way. I don’t think we should glorify big payouts. Those are for the very best traders. But before you become one of the best, it takes time.

So, if any beginner traders are reading this interview, I’d like to tell them: focus on completing the challenge and securing any payout—even a small one. You don’t need to hit the jackpot on your first payout.

The reason is simple—Fintokei refunds your challenge fee with your first payout. Once you reach this point, a huge weight lifts off your shoulders. You’re at break-even, and you no longer have any of your own money at stake. This allows you to trade with more confidence, take riskier trades, and if it doesn’t work out and you lose the account, you can use the refunded challenge fee to immediately try again.

That’s an interesting approach, but knowing our traders, they’ll want to hear the number (laughs).

Alright, my highest payout was around $3,200. So compared to the top payout earners, it’s not that much. But that’s not what trading is about for me. I focus on consistency and repeating success over and over—not just hitting one big payout by luck and then burning through multiple accounts.

For me, any payout is a reason to celebrate. It took me around three months to get my first payout with Fintokei. But that’s the point—I never tried to rush it. Honestly, I don’t understand traders who say they completed the evaluation in just a few days. To me, that sounds like gambling, and it’s not sustainable in the long run.

Kamil, before we move on to analyzing one of your trades, do you have any advice for traders trying to complete the Fintokei challenge?

I’d like to emphasize the importance of not rushing trades. Many traders starting with prop trading today don’t realize how much of a luxury it is that most challenges no longer have a strict time limit for completion. When I first got into prop trading, it was completely normal to have 30 days for Phase 1 and 60 days for Phase 2. Luckily, those days are long gone, and traders now have an amazing opportunity to take their time and wait for the best setups. So, if you’re entering prop trading with some basic trading knowledge, just wait for really strong setups, manage your risk, and success will come. There’s no need to rush.

Trade Analysis – A Look at Kamil’s Trading Style

Alright, Kamil, can you walk us through one of your trades that you’re particularly proud of?

Of course! First, I should explain how I approach trading. I mainly focus on technical analysis—I don’t put much trust in fundamentals. In my opinion, fundamentals are distorted by the media, which presents them in a certain way, influencing the markets differently than expected.

I rely on key indicators like:

📌 Bollinger Bands (D1, W1, Mn timeframes)

📌 Moving Averages on all timeframes

📌 EMA32 HL/2 and EMA89 HL/2 for European indices

📌 SMA200 added for U.S. indices

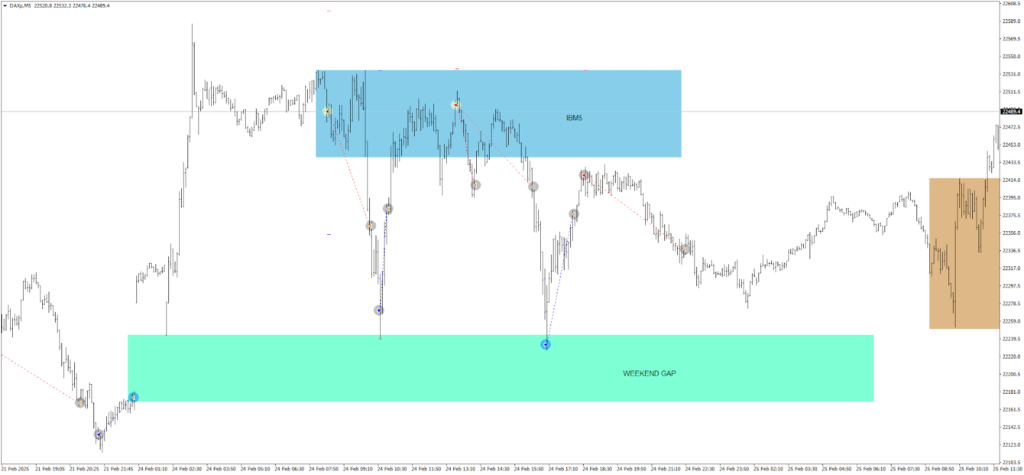

But the most important part of my strategy is Initial Balance Levels:

🔹IBM5 – The first five minutes after my trading session opens

🔹IBM5US – The first five minutes after the U.S. session opens

🔹IB – The first hour of the U.S. or EU market

If IBM5 shows a bullish structure, I never go short—no matter what. It’s all about trading with the structure, not against it.

Gaps also play a crucial role in my strategy. I divide them into three types:

- Major gaps – When the price opens above/below the previous session. I trade in the direction of these gaps.

- Weekend gaps – If the price opens with a clear gap after the weekend, it often acts as support or resistance.

- Mid-week gaps within the previous session’s range – I completely ignore these.

That’s the general approach—now let’s look at a recent example.

In this case, I entered a short position based on IBM5, which showed a bearish structure.

Target → The weekend gap left after the German election weekend.

Stop-losses for short positions → Above IBM5.

Stop-losses for long positions → I secured profits much faster.

IBM5 helps me identify entry signals and assess risk. During this particular session, I achieved a return of over 3%, starting with just 0.5% risk. With each subsequent trade, I only risked the profits I had already made.

These levels aren’t random—simple strategies work best. I’ve tested advanced tools, but I always come back to the basics. The simpler your rules, the easier it is to stay disciplined and objective.

At the end of the day, I always say—the market is simple, it’s us traders who overcomplicate things (laughs).