【初心者必見】プロップトレーダーが知っておくべき基本トレーディング用語集

これからトレーディングを始めようとしている方。専門用語が多くて戸惑っていませんか?

本記事では、特にプロップトレーディングの世界でよく使われる基本用語を、初心者にもわかりやすく解説します。知識ゼロでも大丈夫。この記事を読めば、自信を持ってチャートや戦略を読み解けるようになります。

主要な用語とトレーディングの原則

スプレッド (Spread)

買値と売値の価格差のことです。 スプレッドが小さいほど、取引のコストは安くなります。特にスキャルピングや日中取引戦略では、このスプレッドの小ささが非常に重要になります。

さて、以下の2つの通貨ペア、どちらのスプレッドがトレーダーにとってより有利だと思いますか?

- EURCZK – 0.0084

- EURUSD – 0.00005

(正解はEURUSDです)

ASK価格 / BID価格

- 買値(ASK価格):買うときの価格です。

- 売値(BID価格):売るときの価格です。 スプレッドはこれら二つの価格の差であり、これが取引手数料の一つとなります。

ピップス (Pips)

「Percentage in Point」の略で、通貨ペアにおける最小の価格変動単位を示します。 ほとんどのFX通貨ペアでは、小数点以下第4位の動きが1ピップに相当します。 例:EUR/USDが1.1050から1.1051に動いた場合、これは1ピップの変動となります。

ロングポジション (Long Position)

価格が上昇すると予測して買い注文を保有することです。

ショートポジション (Short Position)

価格が下降すると予測して売り注文を保有することです。

CFD (Contract for Difference)

「差金決済取引」のことで、実際の資産を保有することなく、その価格変動に投機できる金融派生商品です。分かりやすく言うと、例えば金(ゴールド)をCFDで取引する場合、現物の金を持っているわけではなく、単にその価格差を取引しているに過ぎません。 価格の上昇(ロング)と下降(ショート)の両方を取引でき、レバレッジを活用して少額の資金で大きな取引をすることも可能です。 ほとんどのオンラインブローカーでの取引は、このCFDを介して行われています。もしCFDがなければ、金のチャートで「買い」をクリックしたら、実際に現物の金が送られてくることになりますね。

スワップ (Swap)

ポジションを翌日まで持ち越す際に発生する手数料、または受け取れる金利のことです。通貨間の金利差に基づいて計算されます。 スワップはプラスになることもマイナスになることもあり、長期的に見ると取引結果に影響を与える可能性があります。

💡 ご存知でしたか?

キャリートレード戦略では、プラスのスワップが得られるポジションを長期保有することで、受動的な利益を得ることを目指します。

ストップロス (SL)

「損切り注文」とも呼ばれ、損失を限定するために自動的に不利なポジションを決済する保護注文です。 リスク管理には必須のツールです。 ストップロスを設定しないと、プロップトレーディングのギャンブル行為に該当します。

レバレッジ (Leverage)

少ない資金でより大きな規模のポジションを動かすことを可能にする仕組みです。例えば、1:30のレバレッジがあれば、わずか1,000ドルの資金で30,000ドル分のポジションを保有できます。

⚠️ ただし、レバレッジは利益だけでなく損失も拡大させるため、注意が必要です。

必要証拠金 (Margin)

取引時にポジションを保有するための担保として一時的に確保される資金です。保有資金すべてが自由に使えるわけではなく、一部は証拠金として確保されます。

💡 プロからのヒント

マージンコールには特に注意しましょう。証拠金が極端に少なくなると、プラットフォームが自動的にポジションを強制決済し始めることがあります。

有効証拠金(Equity)

口座残高に未実現の損益(含み益、含み損)・手数料・スワップを加味した証拠金残高を指します。Fintokeiでは、有効証拠金が失格ラインを下回った場合に、口座が失格となるため、注意が必要です。

ボラティリティ (Volatility)

価格変動の大きさを表します。高ボラティリティの市場はチャンスも多い反面、リスクも高まります。市場が激しく上下する状況こそが、トレーダーにとって腕の見せ所なのです!

クイズ:S&P 500のボラティリティが高かったのはいつでしょう?(ヒント:ローソク足の大きさを確認してみてください。)

流動性 (Liquidity)

提示された価格で、どれだけスムーズに売買できるかを示す度合いです。流動性が高いほど、スリッページが少なく、スプレッドがタイトになり、約定もスムーズになります。要するに、その資産を取引する人が多いほど、流動性が高いと言えます。

リスク/リワード比率 (RRR)

潜在的な損失と、それに対する潜在的な利益のバランスを示す指標です。例えば、RRR 1:3とは、100ドルのリスクに対して300ドルの利益を目指すということです。多くのトレーダーは、少なくとも1:2以上のRRRを目指します。

スリッページ (Slippage)

注文した価格と、実際に取引が約定した価格がわずかにずれてしまう現象のことです。通常、重要なニュース発表時や流動性が低い市場状況で発生します。価格の動きによっては、プラスのスリッページ(有利な約定)になることも、マイナスのスリッページ(不利な約定)になることもあります。

ドローダウン (Drawdown)

Fintokeiにおける最も重要な指標の一つです。 口座残高がピークに達した後、損失期間中にどれだけ減少したかを示すものです。まさに「どれだけ痛手を負ったか」を表します。 Fintokeiでは、以下のドローダウンを追跡しています。

- 1日の損失率:1日の取引開始時点の残高から、その日に許容される最大の損失パーセンテージ

- 全体の損失率:初期残高に対して許容される最大の損失パーセンテージ

どちらかの制限を超過すると…チャレンジは終了となります。

| プログラム | 1日の損失率 | 全体の損失率 |

| チャレンジプラン | -5% | -10% |

| 入門プラン | -3% | -6% |

| 速攻プロプラン | ❌ | -10% |

ドローダウンをしっかり管理し、乗りこなすことができる場合、Fintokeiにおいて素晴らしいトレーディングができるでしょう😉

テクニカル分析の基礎

テクニカル分析 (Technical Analysis)

チャートを読み解くことで、市場の心理や行動を分析する手法です。市場はしばしば過去のパターンを繰り返す傾向があります。特定のパターンが形成されたとき、それが再び現れれば、市場が前回と同様の動きをする可能性が高いと考えます。

💡 ご存知でしたか?

テクニカル分析は初心者にも非常に役立ちますが、ファンダメンタル分析と組み合わせることで、さらに強力な分析が可能になります!

サポート (Support)

買い手が積極的に入ってきて、価格が下落しにくくなる水準のことです。価格はここから反発して上昇することがよくあります。この水準を下抜けると、市場の弱さを示唆します。

レジスタンス (Resistance)

売り手が優勢となり、価格が上昇しにくくなる水準のことです。価格はここで上昇が止まったり、下落に転じたりすることがよくあります。この水準を上抜けると、潜在的な強さを示唆します。

💡 ご存知でしたか?

トレーダーはサポートとレジスタンスをまとめて「S/Rレベル」と呼ぶことがよくあります。

S/R(サポート/レジスタンス)レベルがチャートに示されています。トレーダーはこれらのレベルを自身で描画しますが、自動でプロットしてくれるツールも存在します。

移動平均線 (Moving Averages: MA)

価格の動きを滑らかにし、トレンドの方向性を把握するのに役立つテクニカル指標です。

- EMA 20:短期的なトレンドを示します。

- SMA 200:長期的なトレンドを示します。 異なる移動平均線同士のクロスオーバーは、強力な売買シグナルとなることがあります。

💡 ご存知でしたか?

移動平均線は基本的ですが、市場へのエントリータイミングを計る上で非常に堅実なツールです。MACDインジケーターの使い方を学び、市場参入の精度を高めましょう。

リバーサルパターン (Reversal Patterns)

トレンドの転換を示唆するローソク足チャートの形状のことです。「ヘッド&ショルダー」や「ダブルトップ」といった言葉を聞いたことがありますか?リバーサルパターンを見つけることは、トレーディングスキルを一段と向上させるでしょう。

トレーダーでない人にとっては単なるシンプルなチャートですが、訓練されたトレーダーの目には、トレンドの反転を示すダブルトップの形成と映ります。

ダイバージェンス (Divergence)

価格が上昇しているにもかかわらず、RSIやMACDのようなオシレーター系のインジケーターがそれに追随せず、むしろ下降している(またはその逆)状態を指します。これは、現在のトレンドの勢いが弱まっている、あるいはトレンドが反転する可能性を示唆することがあります。

ローソク足パターン (Candlestick Patterns)

トレーダーがローソク足チャートを愛用する最大の理由の一つです。一本一本のローソク足が、同時線(ドージ)、ハンマー、三羽烏(スリー・ブラック・クローズ)といったユニークな名前のパターンを形成します。テクニカル分析のパターンを学ぶことは、トレーディングを極めるための道筋となるでしょう。

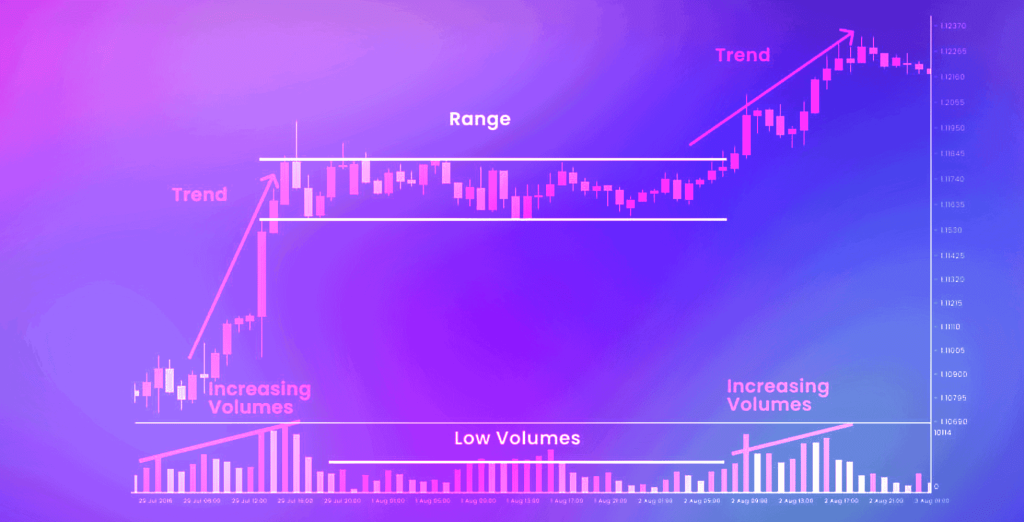

トレンドライン (Trendlines)

高値同士や安値同士を結んで引かれる直線のことで、市場の全体的な方向性を示します。トレンドラインがブレイクされることは、しばしばトレンドの転換が近いことを意味します。

トレーディングスタイルと戦略

スキャルピング (Scalping)

数秒から数分という超短時間で取引を繰り返し、小さな利益を積み重ねるスタイルです。 少ない利益を積み重ねるため、スプレッドの小ささ、高速な約定、そして極めて高い集中力が求められます。

スイングトレード (Swing Trading)

数日から数週間ポジションを保有し、サポート/レジスタンス間のより大きな価格変動を捉えることを目指します。スイングトレーディング戦略は、初心者や日中忙しい方に最適です。

デイトレード (Day Trading)

すべての取引を同じ日中に決済するスタイルです。スワップが発生せず、 翌日持ち越しによるストレスがないため、毎日の取引をすっきりと完結させることができます。

ブレイクアウトトレード (Breakout Trading)

価格が主要な水準(サポート/レジスタンス)を突破した際に取引を開始する戦略です。 ブレイク後には強い動きが続くことがありますが、インジケーターやローソク足パターンで確認を取ることが重要です。

ポジショントレード (Position Trading)

長期的な視点で取引を行うスタイルです。ポジションを数週間、数ヶ月、場合によっては数年間も保有します。大きなトレンドやファンダメンタルズ分析に基づいており、トレーディングというよりも投資に近い考え方です。

知っておくべきマクロ経済用語

ファンダメンタル分析 (Fundamental Analysis)

もう一つの重要な市場分析手法です。これはより高度な内容で、マクロ経済イベント、ニュース、地政学的状況、さらには天候までを追跡します。 トレーダーは経済指標カレンダーを利用して、今後発表される重要な指標やイベント、そしてその市場への潜在的な影響度を確認します。

💡 ヒント

価格がミリ秒単位で動くようなボラティリティの高いイベント中の取引は避けるのが賢明です。

FED (Federal Reserve System)

米国の中央銀行である連邦準備制度理事会のことです。金利を設定し、インフレをコントロールし、市場のムードを大きく左右します。その一言一句が市場を動かす力を持っています。

ECB (European Central Bank)

欧州中央銀行のことです。ユーロ圏のインフレ、金利、そしてDAXのような主要指数にとって極めて重要な存在です。

NFP (Non-Farm Payrolls)

米国の月次雇用統計で、「非農業部門雇用者数」を指します。毎月第1金曜日に発表され、米ドル、金、株価指数に多大な影響を与えます。

CPI / PPI

インフレ関連の指数です。

- CPI(Consumer Price Index):消費者物価指数。

- PPI(Producer Price Index):生産者物価指数。 これらの指数が高いほどインフレ率が高く、それに伴い金利も高くなる傾向があります。

金利 (Interest rates)

中央銀行の主要な金融政策ツールです。金利が高いほど通貨は強くなる傾向があります。中央銀行の金利決定は、市場に大きな影響を与える高インパクトなニュースとなります。

💡 もっと深く学びたいですか?

Fintokeiの各種ニュース記事をぜひご覧ください。主要な用語を分かりやすく解説し、ニュースが市場をどう動かすか、そしてより賢く取引するためのヒントをご紹介しています。

またFintokeiを初めてご利用の方はよくあるご質問をぜひご覧ください。

トレーディングは、市場の言葉を理解することから始まります。一度その言葉を習得すれば、他のトレーダーよりも有利に立つことができるでしょう。

この記事はトレーディングの旅の羅針盤となるはずです。必要な時にいつでも読み返して、知識の再確認にぜひご活用ください。