【実例付き】アメリカのCPIが上がると株価やドル円はどうなる?

「CPI(消費者物価指数)が上がるとどうなるのか?」これはファンダメンタルズ分析を学び始めたトレーダーなら一度は持つ疑問でしょう。

CPIは物価の動きを測る代表的な指標であり、FRB(米連邦準備制度理事会)の金融政策を左右する要因として常に注目されています。

特にFRBには「物価安定」と「最大雇用」という二つの責務があり、その中で物価安定の目標値として掲げられているのが2%のインフレ率です。

では、CPIはどれくらいの基準から上がっているといえるのか、また上がると実際に相場では何が起きるのでしょうか。

この記事では、CPIの上昇や下落がS&P500やドルなどに与える影響、またCPIを押し上げる具体的な要因などを以下の項目でわかりやすく解説します。

- アメリカのCPI(消費者物価指数)の基準は「2%」

- アメリカのCPIが上がる(下がる)とどうなる

- アメリカのCPIが上がる4つの要因

- アメリカのCPIが上がってもセオリー通りにならないこともある

- Fintokeiではファンダメンタルズ分析に役立つツールを提供

- まとめ

アメリカのCPI(消費者物価指数)の基準は「2%」

アメリカの物価上昇を確認する上で重要なのは、「2%」という数値です。

FRB(連邦準備制度)の声明文によると、「個人消費支出価格指数(PCE)の年間変化率で測られる2%のインフレ率が、FRBに課せられた「最大雇用」と「物価の安定」という使命に最も合致する」とされています。

参照:Why does the Federal Reserve aim for inflation of 2 percent over the longer run?

つまり、デフレを避けつつ購買力を大きく損なわない「緩やかな上昇率」の基準として、アメリカの中央銀行はPCE2%という数値に注目しているのです。

計算方法が原因でPCEよりもCPIのほうが若干数値が高まりやすい傾向にはあるものの、CPIも同様です。

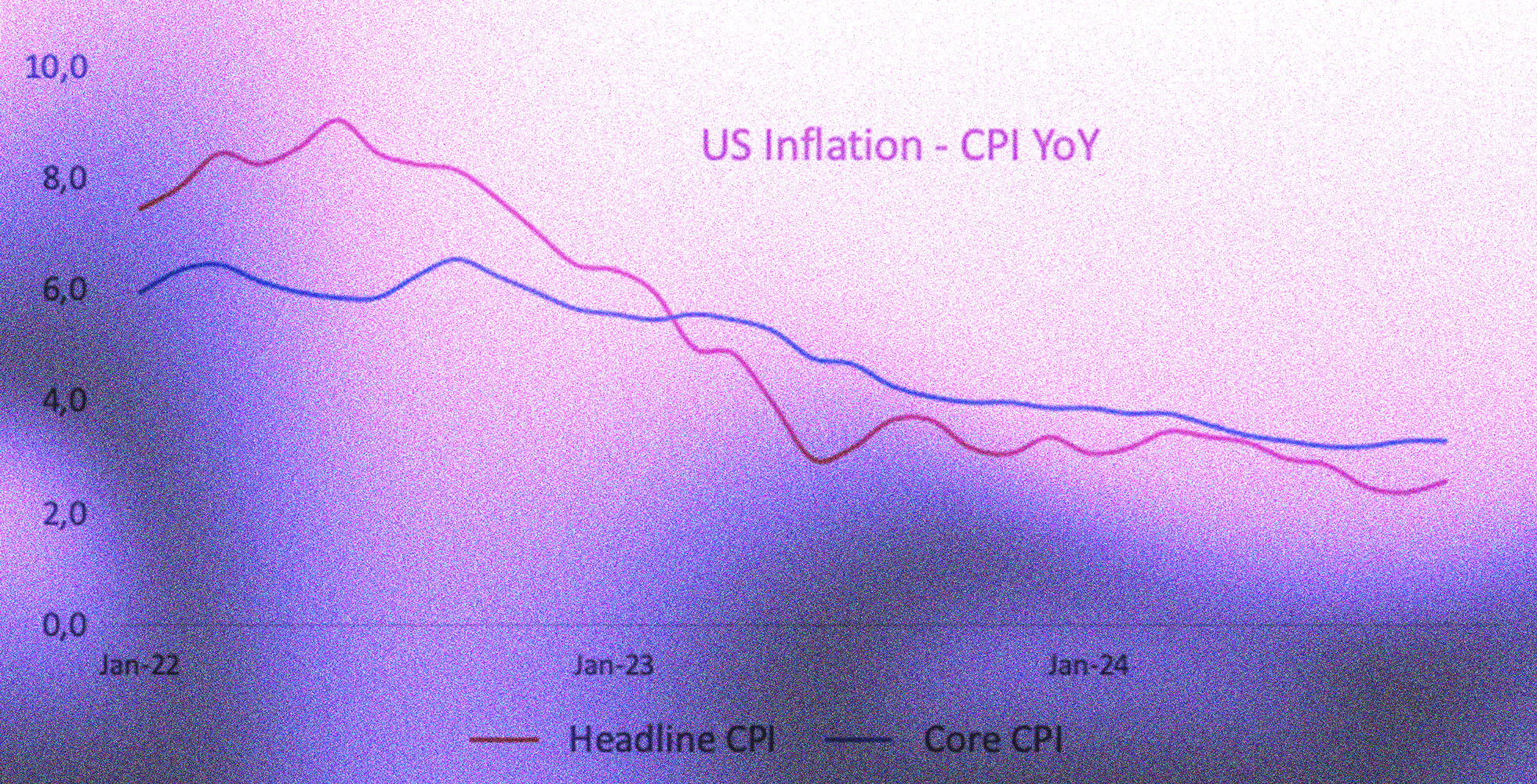

2015年以降、コロナ渦への突入までは総合CPI2%前後での安定が意識されていたことが分かります。

グラフ作成の参考元:U.S. Bureau of Labor Statistics

2025年現在、高インフレ下の影響を受けてCPIは高水準で推移しているものの、CPIが上がるのかまたは下がるのかに注目する際は長期的に2%という数値が重要になってくることは覚えておきましょう。

CPIとCPEの違いについては、以下の記事で詳しく解説しているのでぜひ参考にしてください。

≫【5分で理解】CPIとPCEの違い|PPIとの関係性やすぐに使える指標も紹介

アメリカのCPIが上がる(下がる)とどうなる

アメリカのCPI(消費者物価指数)が上がるまたは下がることで価格に生じる影響は、銘柄によって異なります。

ここでは、以下の3銘柄に焦点を当てて見ていきましょう。

- 米国株(S&P500)

- 為替(ドル円)

- ゴールド(XAUUSD)

米国株(S&P500)

アメリカのCPIが上がると一般的に米国株は下落へ、逆に下がると上昇へ繋がりやすいです。

米国経済のGDPは需要項目別にみると、個人消費が約70%を占めています。

しかし物価上昇で生活必需品やサービス価格が上がれば、家計の購買意欲がそがれ、GDPの大部分を占める個人消費が落ち込みやすくなります。

出典:FRED

こうした消費の減速は企業の売上や利益の悪化につながり、結果として株式市場にはマイナス材料となりやすいのです。

実際に2021年5月12日に発表された総合CPI(前年比)は予想を上回り、かつ前月からも大幅な上昇を見せ4%台に乗せたことでS&P500指数は一時下落へ繋がりました。

| CPIの発表時期 | 予想値 | 結果 |

| 2021年5月12日 | 3.6% | 4.2% |

| 2021年4月13日 | 2.5% | 2.6% |

為替(ドル円)

米国株と違って、CPIが上がると一般的にドル円は上昇(ドル高)しやすく、下がると下落(ドル安)しやすい傾向にあります。

FRBは最大雇用と物価安定を法的使命(デュアルマンデート)としているので、CPIが上昇して高インフレが意識されると使命達成のために引き締め(利上げ)を行う方針を立てます。

利上げが実施されれば米国債利回りが上がり、投資家にとってドル建て資産の魅力が増すため、為替市場ではドル高が進みやすいのです。

実際に先ほど紹介をした2021年5月12日のCPI発表時には、ドル高によってドル円が上昇しています。つまりCPIの上昇が株安ドル高進行へのきっかけとなったわけです。

ゴールド(XAUUSD)

CPIが上昇した場合、ドル建てゴールドはインフレヘッジ資産として買われやすい一方で、米金利の上昇が進むと売られやすいという相反する動きになります。

ゴールドは利息や配当を生まないため、米金利が上がると投資先としての魅力が相対的に低下します。

しかしインフレが進むとドルという通貨自体の実質価値が下がるので、資産防衛の手段として金が買われる傾向にあります。

その結果、CPIの上昇は「インフレ懸念によるゴールド買い」と「利上げ(ドル高)によるゴールド売り」という綱引きを起こすのです。

実際に2021年5月12日のCPIでは、ドル高によって一時ゴールドが売られたものの、インフレヘッジ資産として機能する面もあるため底は固く上昇へ転じました。

ゴールドとドルの関係性については、以下の記事で詳しく解説しているのでぜひ参考にしてください。

≫ドル円とゴールドの相関が崩壊?知っておきたい5つの理由

アメリカのCPIが上がる4つの要因

アメリカのCPIが上がると各銘柄がどうなるのかを理解した上で、そもそもCPIが上がる要因にはどのようなものがあるのか、以下について見ていきましょう。

- サプライチェーンの混乱による供給不足

- エネルギー価格の高騰

- 労働市場の逼迫や賃金上昇

- 家賃や帰属家賃の上昇

サプライチェーンの混乱による供給不足

サプライチェーン(物流)の混乱による供給不足によって、需要急増に比して供給が追いつかない状況では商品価格が上昇しやすくなり、つまりCPIが押し上げられやすくなります。

その傾向が顕著に見られたのは、パンデミック時です。

米国労働省労働統計局(BLS)は、2021年第2四半期の高インフレについて、「自動車や家電などの耐久財に対する需要とサプライチェーンの混乱による供給制約の複合的な影響が主要因である」と述べていました。

参照:What caused the high inflation during the COVID-19 period?

エネルギー価格の高騰

原油やガソリン価格は特に生活必需的な支出なので、エネルギー価格の変動はCPIに大きな影響を与えます。

FRBのリサーチによると、2022年前半の原油供給ショックだけでヘッドラインインフレを年間換算で1.0%ほど押し上げたと推計されています。

つまり、エネルギー価格の上昇が直接的にCPIを押し上げたという訳です。

参照:Oil Price Shocks and Inflation in a DSGE Model of the Global Economy

実際にガソリン価格とCPIの推移を見比べてみても、動きに相関性が見られるのは明らかでしょう。

出典:FRED

労働市場の逼迫や賃金上昇

労働市場の逼迫や賃金上昇は、CPIの中でも特にサービス価格の持続的な上昇要因となり、インフレの基盤を強めます。

労働コストはサービス価格に直結するため、求人倍率の高まりや人手不足が続けば、賃金上昇→サービス価格上昇という流れが生じます。

2021年以降、雇用者一人当たりの賃金コスト(ECI)は前年比4%超の伸びを記録し、過去10年で最も高い水準となりました。

この賃金上昇が外食、医療、宿泊といったサービス価格を押し上げ、CPIのコア部分を長期にわたり高止まりさせました。

出典:FRED

サービス価格の上昇が賃金インフレを引き起こしたという見方もあるものの、労働市場の逼迫はCPIを一時的に動かすエネルギーや供給不足とは異なり、「粘着的なインフレ」を生み出す構造的要因として注目しておいた方が良いでしょう。

家賃や帰属家賃の上昇

住居費はCPIの中で最も大きな構成要素であり、家賃や帰属家賃の上昇はインフレ全体を押し上げる要因となります。

つまりCPIの算出項目のうち他の項目が落ち着いても、家賃や住宅ローン関連コストが上がればCPI全体が高止まりしやすい構造なのです。

実際に2023年3月のFRB議事録の中では「住居費上昇がコアインフレの粘着性を生んでいる」と言及されています。

参照:Minutes of the Federal Open Market Committee

つまり、住宅費はCPIにおける「最大の重し」であり、家賃動向を見極めることがインフレ見通しを理解する上で欠かせません。

アメリカのCPIが上がってもセオリー通りにならないこともある

アメリカのCPIが上がっても、「ドル高・株安・金利上昇」というセオリー通りにならないこともあります。

教科書通りに相場が進まない代表的な原因の1つが、市場の織り込み済みです。

CPIが大きく上振れしてもすでに市場参加者がその可能性を織り込んでいる場合、発表後の相場はセオリー通りに動かず材料出尽くしで逆方向に反応することがあります。

実際に2021年12月の米国総合CPIは前年比+6.8%と11月を超える高水準でしたが、市場予想と一致したため株式市場はむしろ上昇、かつドル安へと進行しました。

| CPIの発表時期 | 予想値 | 結果 |

| 2021年12月10日 | 6.8% | 6.8% |

| 2021年11月10日 | 5.8% | 6.2% |

| 2021年10月13日 | 5.3% | 5.4% |

他にもインフレ率が高くても、同時に景気悪化が強く意識される局面などではセオリー通りに推移しないケースがあるため注意が必要です。

Fintokeiではファンダメンタルズ分析に役立つツールを提供

Fintokeiとは、個人トレーダーがプロトレーダーに挑戦する場を提供しているプロップファームです。

Fintokeiでは、デモ環境を使って仮想資金を運用していき、損失率を抑えつつ、一定以上の利益率を達成することを目指します。

目標を達成するとFintokei公認のプロトレーダーになれ、データ提供料としてデモ口座における取引利益額をもとに報酬を獲得いただけます。

またFintokeiのマイページでは、経済指標の予定や直近のニュースなどを動画で確認できる「デイリーマーケットニュース」を提供しています。

デイリーマーケットニュースではトレードで役立つ最新ニュースだけでなく、どのような経済指標の発表が予定されているのかも知ることができます。

また、経済指標が何を意味しているのかも解説しているので、ファンダメンタルズ分析初心者にもおすすめです。

Fintokeiでは最低1万円台からプロトレーダーへ挑戦できる豊富なプランが用意されているだけでなく、無料トライアルも活用できます。

Fintokeiの無料トライアルへ参加する方法については、以下の記事で詳しく解説しているのでぜひ参考にしてください。

≫Fintokeiの無料トライアルに参加する方法や注意点を解説

まとめ

この記事では、アメリカのCPI(消費者物価指数)がどの基準から上がったといえるのか、また上がった結果、相場にどのような影響を与えるのかなどを詳しく解説しました。

サプライチェーンの混乱やエネルギー価格の高騰、労働市場の逼迫、住宅費の上昇といった要素は、時に相場をセオリー通りに動かし、時に市場予想の織り込みによって逆の動きを見せることもあります。

だからこそCPIは、トレーダーにとって最も注目すべき経済指標のひとつなのです。

実際のトレードでは、こうしたCPIの特徴を理解しておくことで、為替や株式、ゴールドの動きに柔軟に対応する判断力が養われます。

今後の相場で一歩先を読むために、ぜひCPIを活用した分析を実践に取り入れてみてください。